On a number of projects I have had to work with numerous datasets.

As an example, for a client with a global trading business the requirement included:

- Bloomberg codes for FIX trading of futures

- RIC codes for FIX trading of equities

- ISIN codes for FIX trading of some participation notes

- ISIN codes for FIX trading of some Fixed Income instruments

- CUSIP codes for FIX trading of some Fixed Income instruments

- Synthetic instrument codes for some money market instruments

Positions were managed for some instruments using Sedol codes and for others ISINs. And for money market instruments, synthetic identifiers. A real mish-mash...

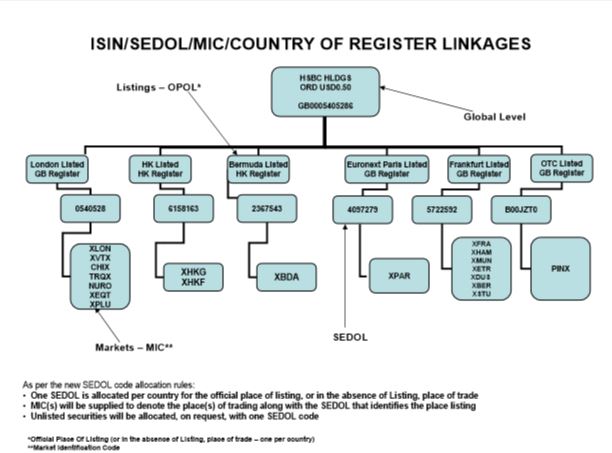

Some good collateral material can be found at the LSE and specifically ISIN/SEDOL/MIC/Country of Register linkages-HSBC - See image below

There is a good background piece on the ISIN vs Bloomberg Open Symbology initiative here.

The challenge is that when seeking to ensure that risk positions are managed correctly, there is usually a requirement for a cross reference table, such that there is a mapping

Bloomberg == RIC == Sedol + MIC == ISIN + MIC + Currency Code

(and so on for every different symbology)

|

| ISIN/SEDOL/MIC/Country of Register linkages-HSBC |

London is full of smart folks trying to offer the next big thing within fintech. This data proposal is nowhere near as glamorous and would be a nightmare to negotiate - imagine trying to get Reuters and Bloomberg to play nicely together...

But think of the efficiency gains to everyone in the industry. Not "yet another identifier scheme" but a grand business utility to organise and rationalise the existing data symbology.

nice

ReplyDelete