As a general rule, this blog has avoided crystal ball gazing and has tried to maintain a mixture of content around Electronic Trading, Fixed Income, ETFs, FIX, buy-side technology, sell-side technology, Excel, Middleware and a few other topics.Recently the topic of Fixed Income liquidity has been cropping up again and again and there seems to be a lot of misplaced concerns about this topic. As readers will know, I am a fan of examples and analogies, so I will look at this topic from an initial perspective of looking at equity trading.

We can also see that the last five trades were all at the same price from the time and sales data shown on the website:

So, simplifying somewhat, we can see that for a very liquid stock such as Vodafone the impact of these small trades on the market is negligible - that there is enough depth in the book to allow these trades to occur without the price moving.

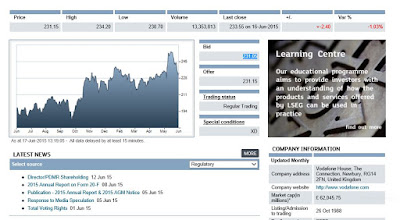

Let's look at an example of a well known UK stock - Vodafone. Here's a link to the LSE website with delayed information on trading today (if you are reading this during LSE market hours, else last trading day close of business if not).

At time of writing we see a Bid of 231.05 and an Ask of 231.15. We can see this in the screen grab below:

We can also see that the last five trades were all at the same price from the time and sales data shown on the website:

So, simplifying somewhat, we can see that for a very liquid stock such as Vodafone the impact of these small trades on the market is negligible - that there is enough depth in the book to allow these trades to occur without the price moving.

That's the key to the this analysis. The equity market is very used to the idea of market impact as a key determinant of trading strategy implementation. In other words, if you are going to carry out a trade that may start to impact the market price then you would conduct a pre-trade analysis of the market and conduct real-time analysis during the trade to see if you are impacting the price in the market.

There is a mountain of literature on this topic and there is of course at least one rather well known book. My experience on a number of equity trading desks was that the better desks would have access to pre-trade, at-trade and post-trade analytics to allow trading strategies to have a feedback loop - a "virtuous circle". In other words, if a trade is not going to plan, allow for human intervention to prevent a botched trade. One key part of the pre-trade analysis is a market impact analysis - what is the expected impact on the market price during the course of trading that particular order?

In essence this is a big data problem - looking at volume profiles for that stock, seasonal trends, news flow and a host of other data points to bring forth an expected price impact of the trade during the lifetime of the trade. In some cases this will just be a single number showing the expected completion price of the order - an average price for execution of the order. In other cases I have this seen this presented as a projection of executed quantity and expected price for each execution. The specifics are of course related to the level of complexity of the implementation.

The point is that within an equity trading business there is a mountain of data "big data" that is used. The typical tier one bank will use a tick database to capture every tick for the equity in question as well as every other equity where there is or could be correlation as well as relevant futures and options and ETFs. This data is then crunched and the bank can have a degree of confidence around the expected outcome of the trade during "normal" times. Of course, during times of market disruption all bets are off and we can see what happens when genius failed during a six sigma event.

Within the Fixed Income world there has not been this level of data available. In the US there is TRACE "The Trade Reporting and Compliance Engine is the FINRA developed vehicle that facilitates the mandatory reporting of over the counter secondary market transactions in eligible fixed income securities. All broker/dealers who are FINRA member firms have an obligation to report transactions in corporate bonds to TRACE under an SEC approved set of rules."

Outside of the US the data is patchy. A buys-side can create an RFQ for a bond using a direct FIX connection or more likely a platform such as Bloomberg, Tradeweb, MarketAxess, Bondvision etc. but that will time out after a short period and so even if captured tick-by-tick the data will be patchy. Banks will generally get a bit grumpy if a buy-side keeps creating RFQs and not trading as they don't want their pricing models to be reverse-engineered (even though it's generally a trivial exercise to do that when you have a generally accepted model for pricing a specific bond).

So, buy-sides will not usually have the big data and the analytics needed to calculate a meaningful normal times market impact - this will instead be a human judgement by the dealer executing the trade on behalf of the portfolio manager (or a manager/dealer in a firm without role segregation).

In the absence of data people will often self-generate expectations based on noisy information such as news flow rather than any fundamentals - perception as it's own reality.

So, bearing the above in mind, let us propose a scenario...

An ETF provider that engages in a derivative based replication strategy has a number of contracts with a counterparty that is not in good shape. Informed investors start to sell off ETF units in the affected ETFs. This is a reasonable course of action to minimise risk. In this case the ETF provider will have to unwind some derivative contracts with the counterparty which may not have a direct impact on the actual underlying instruments on which the ETF is based (this depends on how the counterparty hedged the derivatives).

Less well informed investors start to dump full replication and/or stratified replication ETF units from other providers that are invested in the same index or market segment. In these cases the ETF provider will eventually have to raise cash to fund redemptions if authorised participants are not willing to carry the units on their own book.

Now we see problems starting to occur. Since the ETF is priced in real-time on the exchange(s) of listing investors will expect to receive the market bid if they sell their holding. Individually that is a reasonable expectation for small sizes of holding (refer back to the Vodafone time and sales example above) but when there are many sellers the authorised participants/market makers will have to adjust their quotes.

The ETF provider then has to sell to the market - this has been covered here before "ETFs, liquidity profile and valuation issues".

Prices then start to move in a discontinuous fashion as the notion of "mark-to-market" is replaced by "mark-to-whatever-you-can-sell-for" and vulture funds become the only bid for the cash raising by the ETFs.

At the point where all this starts, the madness of crowds intervenes...

We can get into the specifics of individual ETF documentation, in specie redemption, adjustments to ensure fairness to sellers and holders and a mountain of logic and legalese. But the madness of crowds has it's own special, flawed, logic.

So - what's the "too long, didn't read" version of this? It's an example of the corset theory of weight loss. Let me clarify...

A corset can reduce the size of a waist, but it cannot reduce the weight of the wearer, the weight is merely redistributed. By packaging up illiquid assets into a vehicle that produces a continuously priced asset there is an illusion of liquidity. But the illiquidity is still there, just with one degree of indirection.

The point here is that Fixed Income assets are not equities - they exist for a different purpose and should be treated differently.